stock option exercise tax calculator

Get side-by-side comparisons of different plans for your equity in 10 minutes or less. Enter the number of stock options you have granted to you.

When To Exercise Stock Options

This calculator illustrates the tax benefits of exercising your stock options before IPO.

. Exercise incentive stock options without paying the alternative minimum tax. Ad Receive a free funding offer to cover all your option exercise costs including tax. XSP Provides Greater Flexibility for Options Traders.

Calculate the costs to exercise your stock options - including taxes. Exercising stock options and taxes. Learn to Trade XSP Today.

Visit The Official Edward Jones Site. New Look At Your Financial Strategy. Find a Dedicated Financial Advisor Now.

Calculate the costs to exercise your stock options - including taxes. NSO Tax Occasion 1 - At Exercise. When your stock options vest on January 1 you decide to exercise your shares.

Stock Option Tax Calculator. Lets explore what it means to exercise stock options the taxes you may need to pay and the common times people exercise their options. According to the calculator at the end of five years 500 shares of stock will be worth 13224.

Fund all your stock option exercise expenses including tax - with no out-of-pocket costs. On this page is an Incentive Stock Options or ISO calculator. Fund all your stock option exercise expenses including tax - with no out-of-pocket costs.

Stock Option Tax Calculator. Ad Trade on One of Three Powerful Platforms Built by Traders For Traders. You pay the stock.

What will my options be worth if my companys stock price changes. On this page is a non-qualified stock option or NSO calculator. Alternative minimum tax AMT calculator with deductions and estimates your tax after exercising Incentive Stock Options ISO for 2022.

Exercise tax bills can become pretty extreme. Calculate the costs to exercise your. You will only need to pay the greater of.

Your stock options cost 1000 100 share options x 10 grant price. The Stock Option Plan specifies the employees or class of employees eligible to receive options. A non-qualified stock option NSO tax calculator estimates your gain in a hypothetical exercise scenario and computes the associated costs.

Exercise incentive stock options without paying the. Please enter your option information below to see your potential savings. Input details about your options grant and tax rates and the tool will estimate your total cost to exercise your grant and your.

This permalink creates a unique url for this online calculator with your saved information. Purchase your shares of. Enter the strike price per share.

Ad For Private and Public Companies Who Want Equity Plans Done Right. It requires data such as. The tax implications of exercising stock options.

How much are your stock options worth. Ad Mini-SPX Index Options are 110 the Size of the Standard SPX Options Contract. When logging into your stock option portal you should have four options to choose from with your 100 stock options.

Do Your Investments Align with Your Goals. Ad Calculate the impact of dividend growth and reinvestment. Subtracting the 10000 it would cost to exercise the options shows a pre-tax.

When you exercise an NSO you pay the company who issued the NSO the exercise price also known as the strike price to buy a share. Enter the number of years you would like to forecast the ESOs future value. See your gain taxes due and net proceeds with this calculator.

The tool will estimate how much tax youll pay plus your total return on your non-qualified stock options under two scenarios. Stock Option Tax Calculator. Ad Receive a free funding offer to cover all your option exercise costs including tax.

Then can get as much as 10x higher than the strike price you pay to actually. Click to follow the link and save it to your Favorites so. The Stock Option Plan specifies the total number of shares in the option pool.

Maximize your stock compensation gains and prevent. The stock price is 50.

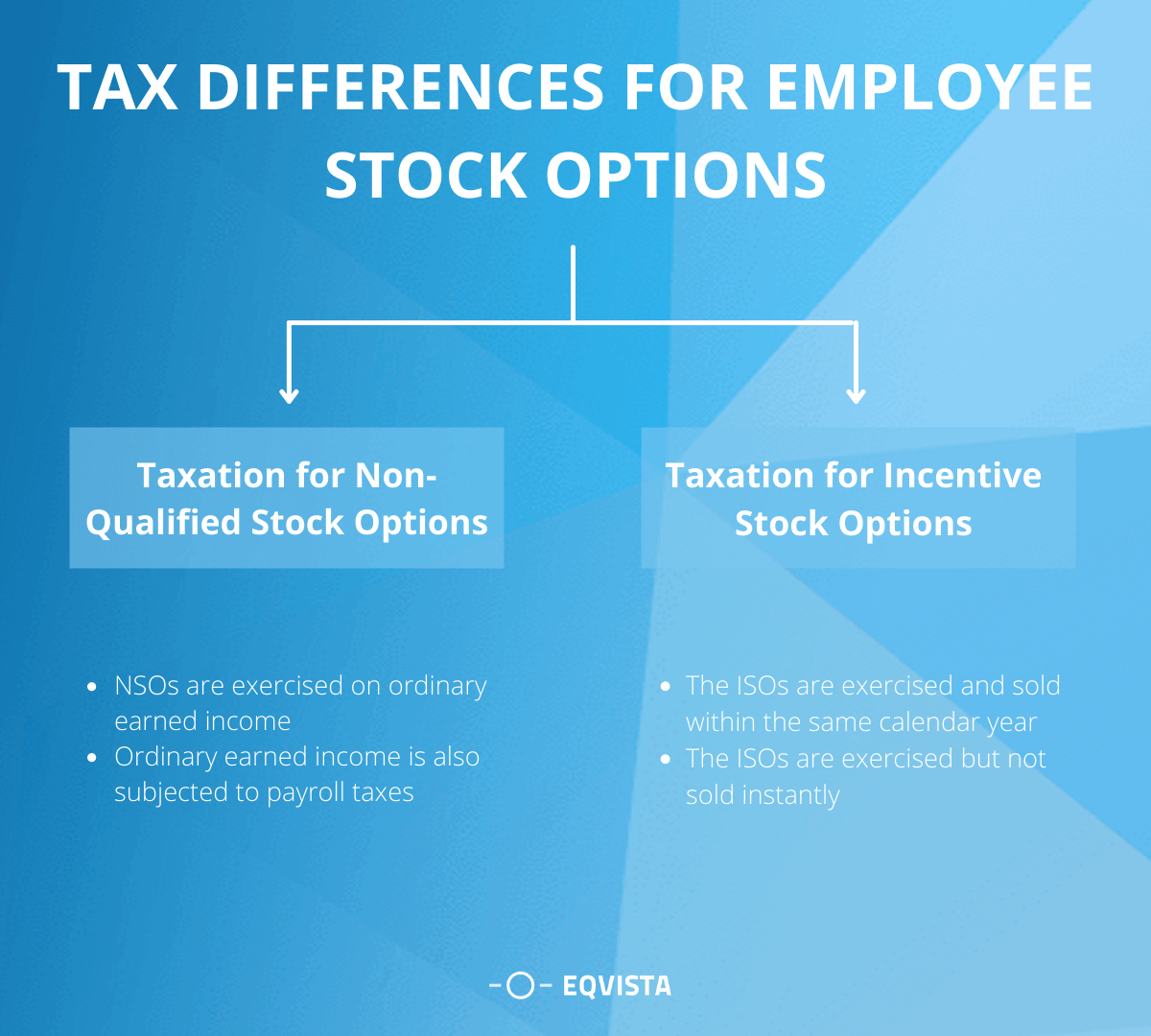

How Stock Options Are Taxed Carta

Non Qualified Stock Options Nsos

How Much Are My Options Worth Eso Fund

Video Included What Is An Employee Stock Option Mystockoptions Com

How Stock Options Are Taxed Carta

When Should You Exercise Your Nonqualified Stock Options

/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-01-270d01a202284fcc98be049a8cdbbb40.jpg)

Employee Stock Option Eso Definition

Employee Stock Options Financial Edge

Qualified Vs Non Qualified Stock Options Difference And Comparison Diffen

Stock Options 101 The Essentials Mystockoptions Com

Tax Planning For Stock Options

How Stock Options Are Taxed Carta

Employee Stock Options And 409a Valuations Eqvista

What Are The Holding Period Requirements Of An Iso Mystockoptions Com